News

LTG’s Unaudited Net Income at Php4.2 Billion for 2014

March 20, 2015

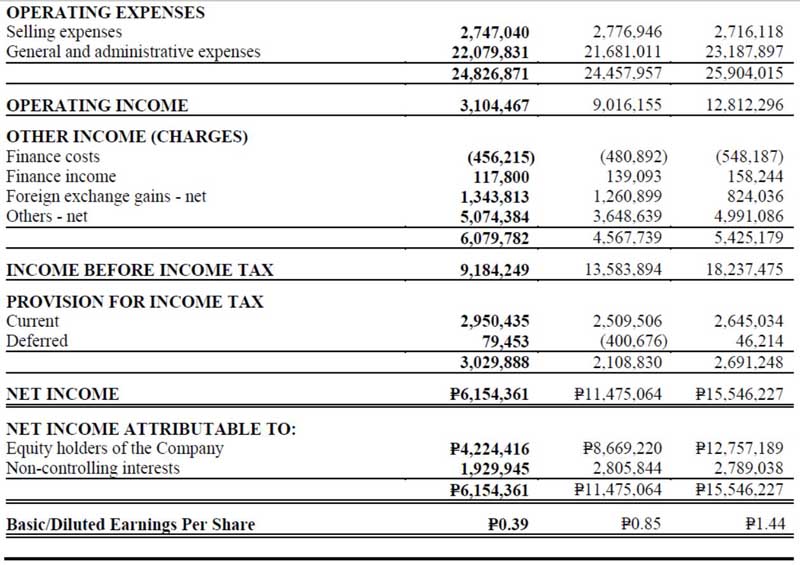

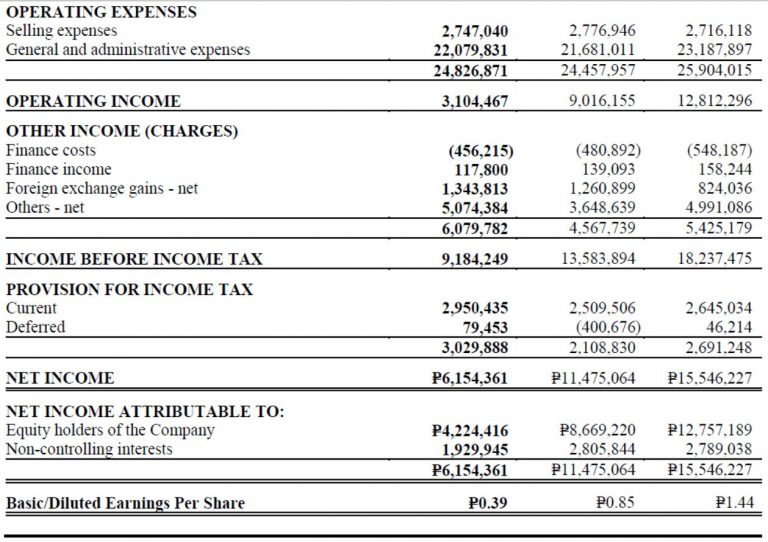

LT Group, Inc. (LTG) reported an unaudited attributable net income of Php4.2 billion for 2014, compared to Php8.7 billion in 2013, with the continuing difficult operating environment of its tobacco business.

Philippine National Bank’s (PNB) unaudited attributable net income contribution to LTG amounted to Php2.4 billion or 52% of total. Asia Brewery, Inc. (ABI) contributed Php1.1 billion or 27% of total, followed by Eton Properties at Php119 million or 3%. Tanduay Distillers, Inc. (TDI) and the tobacco business each provided 2% at Php101 million and Php99 million, respectively. The balance was largely from the Php335 million gain on the purchase of Victorias Milling Company (VMC) shares, and Php45 million from LTG’s share in VMC’s income.

LTG’s balance sheet remained strong, with the parent company’s cash balance at Php8.1 billion as of the end of 2014. Debt-to-Equity Ratio was at 3.36:1 as of year-end with the bank, and at 0.18:1 without the bank.

Philippine National Bank (PNB)

PNB’s unaudited profit was at Php5.6 billion in 2014, 10% lower than 2013’s Php6.2 billion. This is largely due to higher trading gains last year. In 2013, PNB booked Php7.2 bn in trading gains, substantially higher than the Php2.6 billion realized in 2014.

Meanwhile, Net Interest Income was 19% higher year-on-year (y-o-y) to Php16.9 billion on the back of lower costs, coupled with the growth in loans.

Asia Brewery, Inc. (ABI)

ABI’s unaudited net income for 2014 reached Php1.1 billion, 8% more than the Php1.0 billion reported in 2013.

ABI’s brands Cobra (carbonated energy drink), and Absolute and Summit (water) continue to be market leaders. Tanduay Ice has over 90% of the alcopop market.

Eton Properties

Eton’s unaudited net income amounted to Php120 million in 2014.

Leasing revenues were higher with the contribution of Centris Cyberpod Three, the latest BPO office building at Eton Centris, in Quezon City, Metro Manila.

Tanduay Distillers, Inc. (TDI)

TDI’s sales volume increased 17% y-o-y in 2014 due to intensified marketing efforts for its flagship product, Tanduay Five Years.

TDI was able to reverse the loss of Php172 million in the first half of 2014, generating an income of Php273 million in the second half of 2014. It ended 2014 with an unaudited net income of Php101 million.

Tobacco

LTG’s income from the tobacco business amounted to Php99 million in 2014, from the Php3.9 billion in 2013. PMFTC continues to be adversely affected by the illicit trade in cigarettes

The government started implementing the Internal Revenue Stamps Integrated System (IRSIS). From December 1, 2014, all local manufacturers were required to affix numbered stamps on each pack of cigarettes, and effective March 1, 2015, all locally manufactured cigarettes in the market should have the said stamps.

LTG’s partner in PMFTC, Philip Morris International (PMI), disclosed that “we have recently witnessed significant positive price movements at the lower end of the market. We believe that the introduction of tax stamps will further improve the competitive environment in a market where cigarette consumption remained resilient last year at around 100 billion units. These developments augur well for profitability to improve over the mid-term and we remain bullish on the prospects for this market.”

Contact

- 11th Floor Unit 3 Bench Tower, 30th Street corner Rizal Drive, Crescent Park West 5, Bonifacio Global City, Taguig City, Philippines

© 2019, LT Group, Inc. All Rights Reserved.

Powered by Mabuhay Digital Technologies Inc.